Les envois de fonds des migrants vers leur famille en Afrique mis à rude épreuve

IFAD Asset Request Portlet

Asset Publisher

African migrants’ family remittances put to the test

By Pedro de Vasconcelos, Martin Fleury

©FIDA/Marco Salustro

In April, the World Bank projected a sharp decline of about 20 per cent in global remittances as a result of the COVID-19 pandemic and shutdown. This is not good news for Africa. Remittances provide the continent with enormous sums – more than US$60 billion a year – and act as a safety net for millions of vulnerable families, particularly in rural areas.

Whether recent or well established, migrants and their descendants have a firmly anchored practice of looking after loved ones in their countries of origin. Historically, remittances have often played a countercyclical role as migrants support their families through crisis situations – as was the case in the Philippines during the avian flu outbreak of 2003.

But diasporas, like countries, are a heterogeneous mix of people. And just as there are many reasons why people leave their countries of origin, the circumstances faced by individuals and groups are highly diverse and constantly evolving.

We wanted to find out how a pandemic that is simultaneously affecting the global North and global South would affect remittance flows and practices.

So we conducted a survey of 226 representatives of African diasporas in Europe and North America between 1 and 17 May 2020. Most countries in the North were under lockdown at the time, with movements restricted, money transfer agencies closed and parts of the economy shut down, penalizing part-time and informal workers.

The survey generated four major findings:

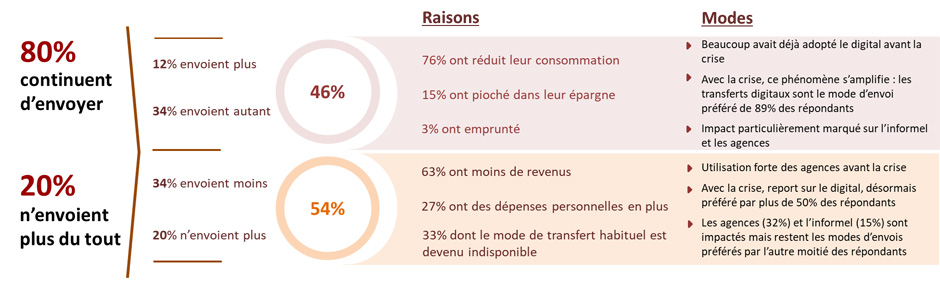

- For many, remittances are a vital and virtually untouchable expense: 80 per cent of respondents continued to send money to Africa despite the lockdown and its consequences.

- Forty-six per cent of respondents managed to either maintain (34 per cent) or increase (12 per cent) the amount of their remittances. In order to do so, most respondents (76 per cent) reduced their own consumption. A smaller number had to dip into their savings (15 per cent) or borrow money (3 per cent). These sacrifices could lead to greater financial vulnerability in the future, or even jeopardize family solidarity if the crisis persists.

- Fifty-four per cent of respondents had to either reduce (34 per cent) or suspend (20 per cent) their remittances, often due to a combination of reasons. First and foremost was a drop in income (63 per cent), followed by their usual transfer method being unavailable (33 per cent) and higher expenses as a result of the lockdown (27 per cent). As it is likely that families’ need for support increased during this period, the gap between diaspora remittance capacity and actual needs undoubtedly grew wider.

- Digital money transfer services are the big winners of the lockdown. They were the preferred transfer method for 70 per cent of respondents. Closed agencies and travel restrictions reduced the volume of cash remittances and the use of informal networks. Among respondents in the Senegalese diaspora, 30 per cent either stopped sending money or reduced the amount sent when these latter channels became unavailable. Still, only the sending of money is digitalized: remittances are still predominantly received in cash, and the hierarchy of operators remains largely unchanged despite the emergence of new actors.

Some operators made significant cuts in their rates during the crisis, while taking advantage of problems affecting informal players. As the crisis may last for an extended period of time, will the changes in habits persist as well? A decision to change operators is often taken after consulting a family member or learning about other people’s experiences through social networks, so word of mouth carries a lot of weight – both positive and negative.

To make remittances more resilient to shocks and render diasporas less vulnerable financially, this study – although just a snapshot of a small sample – suggests encouraging the following steps:

- Lowering transfer fees so that families receive the maximum amount of funds

- Digitalizing remittances, for the sake of convenience and to minimize cash handling, in both North and South

- Providing financial education at both ends to enable people to identify options, either to build savings or to seek more advantageous solutions

- Supporting the move of informal solutions towards formalized channels

- Investing in production to strengthen autonomy in the territories of the South – particularly in rural areas – so that remittances can better support the real economy and job creation.

Martin Fleury is the founder of Red Mangrove Development Advisors. The survey was conducted by Red Mangrove Development Advisors, with technical and financial support from IFAD.

Publication date: 15 June 2020