Promises kept: Crop insurance makes a difference for Kenya’s small-scale farmers

IFAD Asset Request Portlet

Asset Publisher

Promises kept: Crop insurance makes a difference for Kenya’s small-scale farmers

Estimated reading time: 4 minutes

These days, many people are increasingly careful about scams – and the world’s small-scale farmers are no different. Operating as they do in highly risky environments, they’ve learned to be cautious about opportunities that seem too good to be true.

So, when the IFAD-supported KCEP-CRAL programme piloted an insurance policy in 2020, many farmers participating in the programme were sceptical.

Like many in Kwale, a small county in south-east Kenya, participant Fatuma Rashid was hesitant to sign up at first. Others had told her there was no guarantee she’d get anything in return for her premium, so it was difficult to imagine parting with some of her hard-earned income.

Rose Goslinga, CEO of Pula Advisors, the insurance-tech company that offered the policy, understood why farmers were wary.

“Insurance is about a promise,” she says. “When you buy seeds, you can touch them. When you buy fertilizer, you can touch it. But when you buy insurance, you can’t touch it. You’re buying a promise.”

Eventually, thanks to awareness and outreach efforts involving extension agents and farmers’ organizations, thousands of KCEP-CRAL farmers decided to sign up, paying an average of 1,200 Kenyan shillings (about US$11) each.

And as it turned out, the new insurance policies didn’t come a moment too soon.

| Mwagaro, a KCEP-CRAL farmer, discusses the successes she’s had through the project. |

Buying a promise

The policy had been designed specifically to meet the needs of small-scale farmers in KCEP-CRAL’s project areas – the arid and semi-arid lands of Kenya – and to protect their rainfed crops against drought, floods, pests and diseases. It was developed and delivered by Pula Advisors, with support from IFAD’s technical assistance INSURED programme to scale it up.

In 2021, the year after the policy pilot began, drought struck. As with all droughts, the immediate effects were difficult to manage: with household food supplies depleted and livelihoods threatened, many farmers found themselves on the brink of hunger and poverty. Many of the KCEP-CRAL farmers suffered severe losses.

But drought can do more than cause crop losses for one season: its effects can ripple out into the mid- and long term, too. Planting itself can become a risky investment: farmers often buy seeds, fertilizer and other inputs on credit, with repayment due at harvest time. If production is low again, farmers can find themselves both struggling to repay loans and unable to purchase the inputs for the following season to try to get back on their feet.

Crop insurance can buffer the worst of these effects, allowing farmers to avoid the spiral of debt and low production.

“By protecting farmers against risks beyond their control, insurance can be used to ease the transition from recurrent food insecurity to market-oriented agriculture and help strengthen their livelihoods,” said Francesco Rispoli, IFAD’s Country Director for Kenya.

This is especially true when the insurance product is a good match for local conditions. Such is the case with the policy offered through KCEP-CRAL: It’s a kind of financial product known as area yield index insurance, in which harvests are sampled and measured against historical norms and compensation payouts are triggered when agricultural production falls below a set yield threshold.

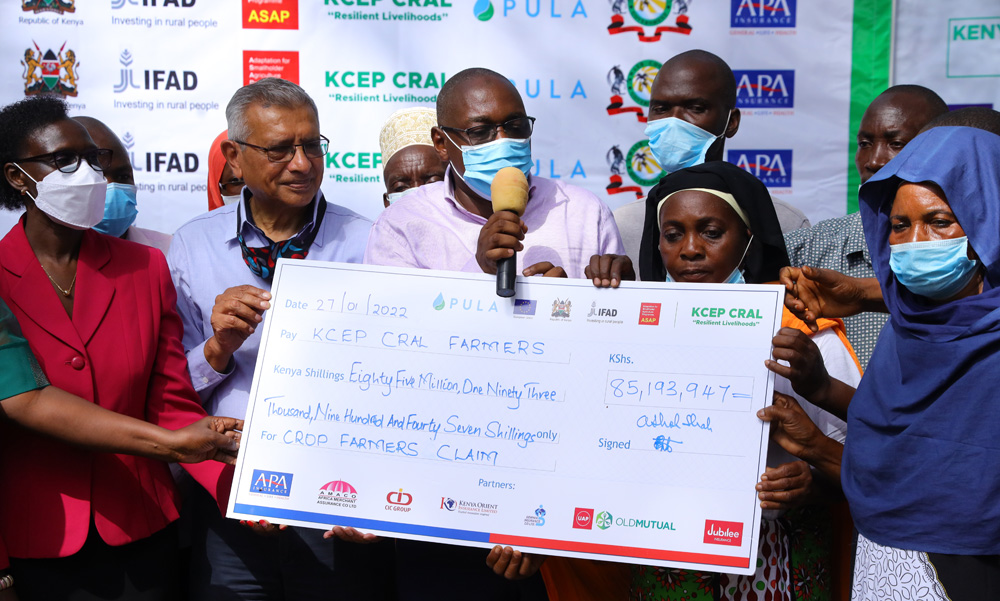

Fortunately, that’s just what happened here. In early 2022, about 11,500 farmers who had purchased the insurance were awarded compensation, for a total of over 85 million Kenyan shillings (about US$750,000). Women made up about 57 per cent of those receiving payouts.

|

| A ceremonial cheque is presented to insured farmers at the payout ceremony. © Pula |

Celebrating the wins

The insurance policy had been offered as part of KCEP-CRAL’s innovative e-voucher initiative, a package that bundles the policy with other financial products and services. The payouts were credited directly to the farmers’ e-wallets, making the money available for the upcoming planting season.

And to make the most of the compensation, and to further raise farmers’ and other stakeholders’ awareness of the benefits of insurance, Pula and KCEP-CRAL organized a festive payout ceremony. Over 400 farmers came to the celebration, which doubled as an agricultural fair with new varieties, inputs and products on show.

Rose Goslinga, Pula CEO, attended the ceremony.

“Today is about showing that the promise is kept,” she said.

Kenya’s Principal Secretary for Agriculture Professor Hamadi Boga, who presided at the fair, agreed. He added that the insurance payout would cushion farmers from the shock caused by the inadequate rains and provide funds for them to purchase inputs for the following season.

And for the farmers in attendance, the ceremony was also a chance to celebrate what they’d achieved.

Fatuma Rashid had decided to purchase the policy after all – and, as she told us, she knew she’d made the right decision. “I’m so glad I will be compensated,” she said.

Musa Omar Mlamba was also in attendance. Although he hadn’t bought the policy, he spoke highly of the benefits he’s seen from taking part in KCEP-CRAL. Thanks to the support he received, he was able to buy goats to herd and increase his maize production fivefold.

And, after hearing about the insurance policy from a neighbour who received the payout, he says he’s going to sign up next time.

KCEP-CRAL has been helping Kenyan small-scale farmers build their resilience and transform their agricultural businesses since 2015. It is co-financed by IFAD, the European Union, participating financial institutions, farmers, and the Government of Kenya, and receives additional financial support from IFAD’s flagship ASAP initiative. The programme also supports a public-private partnership that includes FAO and WFP. KCEP-CRAL has assisted over 180,000 small-scale farmers to date, including more than 103,000 women and 37,000 youth.

Read more about IFAD’s work in Kenya.

Learn more about IFAD’s Insurance Toolkit, a collection of resources to help project designers make agricultural and climate risk insurance work for small-scale farmers.

Publication date: 10 March 2022