Rural Finance Project

IFAD Asset Request Portlet

Asset Publisher

Rural Finance Project

Rural Finance Project

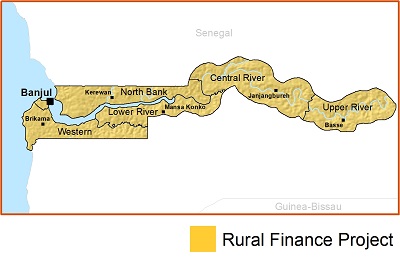

This project provides carefully targeted support to help strengthen and consolidate existing microfinance institutions in The Gambia, enabling them to deliver financial services to economically active poor rural people.

Microfinance offers a range of financial services to the poorest members of local society, who tend to fear debt and who have little or no collateral. In rural areas, microfinance is mainly handled by institutions operating in the semi-formal market, including:

- Village savings and credit associations initiated by IFAD in the late 1980s.

- The network of the National Association of Cooperative Credit Unions of The Gambia.

- The Gambia Women's Finance Association (GAWFA), which takes a group-lending approach.

- The Gambia Microfinance Savings Company Limited, a private, limited-liability financial company.

Project activities include training and technical assistance for service providers to develop new financial products and improve advisory and business services for their rural clients. The project also enhances local communities' access to social and economic infrastructure by linking with initiatives that offer matching grants – such as the World Bank's Community-Driven Development Project and the Social Development Fund supported by the AfDB.

In addition, the project assists existing microfinance institutions in broadening and completing geographical coverage of rural areas.

Using an innovative approach, the project mobilizes traditional village groups to reach target populations of poor men, women and young people as clients for microfinance. Upon the project's completion, an anticipated 180 rural branches of microfinance institutions, and almost 3,000 GAWFA groups, will be delivering financial services, including savings, loans and insurance. About 180,000 rural clients, more than half of them women, will benefit.

Source: IFAD