Rural Financial Intermediation Programme – Phase II

IFAD Asset Request Portlet

Publicador de contenidos

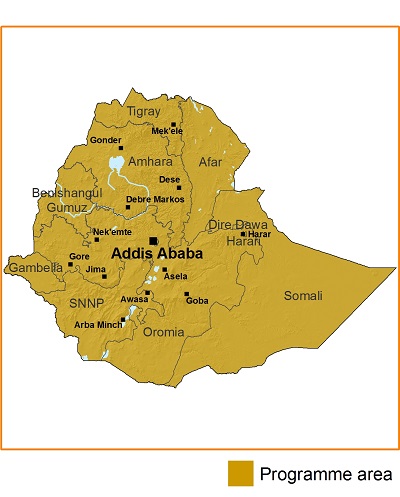

Rural Financial Intermediation Programme II

Building on the lessons and experiences of the Rural Financial Intermediation Programme (RUFIP), which enabled more than 3 million poor rural households to access financial services, this national programme aims to scale up delivery of financial services to reach almost 7 million of these households by 2019. RUFIP II targets poor rural households, making funds available for investment in agriculture and livelihood activities, with a focus on empowering women. Its primary goals include delivering:

- Institutional support to microfinance institutions (MFIs) and cooperatives;

- Investments to improve regulation and supervision of MFIs, and rural savings and credit cooperatives (RUSACCOs);

- A line of credit to bridge liquidity gaps for MFIs and RUSACCOs.

The overall objective of the programme is to provide poor rural people with sustainable access to a range of financial services through a nationwide network of some 30 MFIs and about 5,500 RUSACCOs (and 100 unions of RUSACCOs). It is supporting these rural financial institutions by helping to set up credit funds, and is helping to improve the policy environment by introducing new regulatory and supervisory parameters.

The programme aims to achieve the following specific objectives:

- A total of 6.9 million poor rural households accessing financial services (including 3.2 million households gaining access through MFIs and 400,000 through RUSACCOs);

- Increased savings of approximately 18.5 billion Ethiopian birr (US$1.1 billion equivalent) mobilized over the seven years of programme implementation;

- Increased operational effectiveness of MFIs and RUSACCOs through provision of support and training;

- Some 1,000 new RUSACCOs and 100 cooperative unions established, and at least 4,500 existing RUSACCOs strengthened.

Source: IFAD